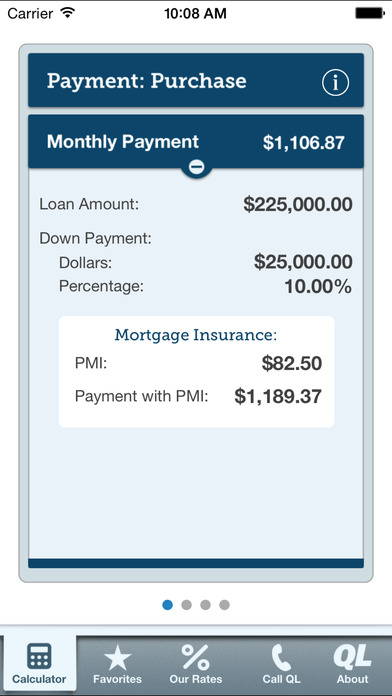

Let’s take a closer look at some of the key considerations with Quicken Loans. There are pros and cons to any decision, and taking out a mortgage is no different. When it comes to securing a mortgage, Quicken Loans is one of the most popular options out there. Both of these rates are in line with the current national average for these types of loans. Quicken Loans is currently offeringģ0-year fixed-rate mortgages at 4.375% and 15-year fixed-rate mortgages at 3.875%. Just be sure to do your research before you commit to anything. They are for-profit and large, but this doesn't mean that they can't be trusted. Overall, Quicken Loans is a reputable company with a good reputation. This can be both good and bad depending on your needs. They are also large enough to offer a wide variety of mortgage products. This means that they have the resources to weather any storms that come their way. This doesn't mean that they are bad, but it does mean that you should be aware of their motives.Īnother thing to consider is that Quicken Loans is a very large company. They are not a non-profit organization that is trying to help people get into homes. This means that they are in business to make money. One thing to keep in mind is that Quicken Loans is a for-profit company. There have been some complaints about the company, but overall they have a good reputation. After all, they are one of the largest mortgage lenders in the United States. Many people are wondering if Quicken Loans is a trustworthy company. Give us a call or visit our website to learn more about how Quicken Loans can help make your dream of homeownership a reality.

If you have any questions along the way, our team is always here to help. On that day, you'll sign all of the necessary paperwork and officially become a homeowner! Once your loan has been funded, we'll work with you to schedule your closing date. This means that we guarantee the interest rate on your loan for a set period of time, so even if rates go up during that time, your rate will stay the same. Once you've been approved for a loan and have chosen the terms that work best for you, it's time to lock in your rate.

From there, we'll work with you to get the rest of the information we need to give you a personalized rate quote. This will give us some basic information about you and your financial situation. The first step is to fill out an online application.

We're here to help explain the process and answer any questions you may have. If you're in the market for a new home or are looking to refinance your current mortgage, you may be wondering how Quicken Loans works. In this article, we'll provide an overview of Quicken Loans' current mortgage rates so that you can make an informed decision about your home loan. If you're looking for a competitive mortgage rate, Quicken Loans is a great place to start. Quicken Loans is one of the leading mortgage providers in the United States.

0 kommentar(er)

0 kommentar(er)